Mobile Banking Application

1 Our Value Proposition

Demand for mobile broadband services is peaking around the world, and mobile broadband is becoming by far, the preferred way to access the Internet. Mobile penetration is above 100% in developed countries and GCC countries with other Arab countries quickly following suite. This means that every person will carry at least one handset being a mobile device, or more recently a tablet device. Furthermore, 99.5% mobile operators worldwide have deployed HSPA (3G), capable of delivering 14.4Mbps downlink speeds and potentially beyond, making data transfers fast and reliable over mobile networks. All this indicates that mobile devices are becoming the preferred means for people to connect to the Internet. Whether for talking, playing, socializing, reading the news, checking the weather, or banking, people will be turning first to their mobile devices to perform needed functions and applications.

The Elbarid Mobile Banking Application allows every banked person carrying a smart phone to perform remote banking operations smoothly, safely, and conveniently. While giving the same functionalities of Internet Banking and more, Mobile Banking will replace Internet banking with time as people are turning more and more to mobile to connect to the internet. Elbarid Mobile Banking Application uses the standardized features of native mobile applications to give and unparalleled user experience combined with the safety and reliability required in such a critical environment.

Elbarid Mobile Banking Application is hence the natural next step evolution, allowing customers to check and manage their accounts, cards, and investment portfolios on the move, from their smart phones and tablet devices.

The Elbarid Mobile Banking Application allows banks to decrease their operating costs while increasing their customers' satisfaction and retaining them.

The banking industry has invested heavily in software development over the past decade to cater for customers' needs. Not anymore! The Elbarid Mobile Banking Application business model is light and flexible allowing banks to remain at the edge of the competition without heavy investment in their own resources.

2 Elbarid is a Trusted Partner

Elbarid was established in 2000 with the objective of developing smart applications that enhance the user banking experience.

Elbarid has been in business with banks since the year 2000 and has handled hundreds of millions of banking transactions.

Elbarid has a history of innovation in the mobile world as it was the creator of the concept of SMS notification of card usage that has been adopted worldwide.

Elbarid team of more than 40 highly qualified engineers initially acquired expertise in developing push SMS applications. This success drove Elbarid, since 2008, to heavily invest in mobile banking solutions.

Elbarid philosophy is to partner with its customers to continuously build innovative advanced technologies whilst enhancing its products to meet its customers ever demanding needs. In view of continuous improvement and product innovation, Elbarid's experience has been to work with the customer through a full project management. The project cycle consists of:

Business Requirements: Elbarid works with clients to identify their business needs and constraints. Subsequently, Elbarid develops the implementation plan and success criteria based on these requirements.

Implementation Plan: Elbarid works hand in hand with the bank's implementation team to define the role of each team member in the implementation process and establish the sequence of actions required to reach implementation goals.

Testing, Approval and Deployment: Elbarid, along with the customer's team installs the application and links it to the customer's data sources while personalizing the product to answer the customer's requirements. The final product will go through a testing, fine tuning and approval process leading to the final deployment that will make it available to the end user.

Constant Evolution: While the initial product offers features meeting or beating the customer's expectations, Elbarid understands that such a product will be outpaced if it's not in constant evolution with new offerings. Therefore it will continuously make available new features that will keep the bank's customers ahead of any other.

3 Advantages and Features

Elbarid Mobile Banking Application provides banks with the most complete, most flexible, and most hassle free solution.

Below are the main features of the Elbarid Mobile Banking Application:

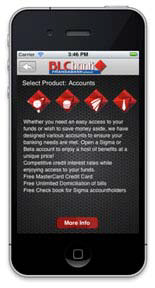

Native Platforms: The application is available for iOS phones (iPhone, iPAD, etc.), Android (Samsung, Motorola, HTC), Blackberry (with limited graphical interface) and soon to be available for Windows mobile phones. Each platform was developed with its native language to benefit from the entire feature set it offers to give the end user an unrivaled user experience and making banking on the move as easy and intuitive as can be.

Customizable: Elbarid understands the need of every bank to be unique and different. This is why the Elbarid Mobile Banking Application provides the ability to customize the user interface of each bank and make it compliant with its corporate brand. Furthermore, Elbarid Mobile Banking Application is built on a modular platform which allows the bank to select the functionalities to make available to its customers. Moreover, each bank can request to add features specific to them. The structure of the Elbarid Mobile Banking Application was designed to allow such upgrades and customizations.

Integration with Bank IT System: The Elbarid Mobile Banking Application is designed as a gateway that is separate from any Banking IT system or environment. While other mobile solutions are hard-coded to a single platform or product that needs to be integrated to the existing bank systems and are, therefore, inherently limited, our flexible platform seamlessly interfaces with virtually any back-end system, including direct database connection or middleware interaction. (See the 'System Architecture" section below for more information).

Fast Installation: Because the Elbarid Mobile Banking Application is merely a gateway to the bank's IT system, it can be installed very rapidly. Deployment is a joint effort between our professional team, the bank's IT department and third party providers.

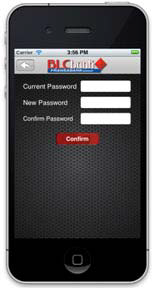

Secure: Elbarid Mobile Banking Application was designed with security as its primary concern. Several levels of security mechanisms are built in the application.

At the core of Elbarid Mobile Banking Application lies Elbarid's proprietary encryption algorithm. Based on dynamic keys generation, encryption is added to the secure data transfer (HTTPS) from the handset to the back-end application. Encryption is also used wherever sensitive data is transmitted within the application.

Users need to be identified to the system through a preset secure enrolment process in order to be granted access.

Before reaching the bank's secured area, communication is filtered and controlled. Access to specific handsets can be turned on and off, and any suspicious activity is blocked before reaching the back end

For optimum security, no data is stored on the handset.

Multiple Languages: Available in English, French, and Arabic, the Elbarid Mobile Banking Application offers a multi-lingual suite of mobile banking services, all neatly packaged under one mobile application. The solution could be made readily available in any other language such as Greek, Russian etc.

Maintenance and Support: Although the stability of the application has been proven, Elbarid team of professional engineers is available 24/7 to answer any call and take proper action in order to insure a smooth and continuous availability of the system.

Hardware and software requirements: Elbarid Mobile Banking Application is a robust and scalable application. Depending on the bank's needs and number of simultaneous users, it will require hardware and software licenses from a single server within the bank's secured area, to a complex set of servers with load balancers. The exact need is to be defined with the business owners and the IT and security team of the bank and will be tailored to its specific needs.